Starting a Business in UAE Mainland: Essential Considerations

Initiating a business in the UAE offers a gateway to a thriving economy, with numerous advantages and a flexible government fostering an ideal environment for businesses. For those considering a venture in this diverse landscape, particularly in the mainland, there are key aspects to grasp before embarking on the journey.

Incentives and Opportunities

The UAE government provides several incentives for businesses in the mainland, including:

100% Foreign Ownership:

Businesses can enjoy full foreign ownership, offering autonomy and control over operations.

Extended Visas:

Entrepreneurs benefit from extended visa options, facilitating a conducive environment for long-term business commitments.

Low Corporate Taxes:

Mainland businesses experience negligible corporate taxes, promoting a tax-friendly atmosphere.

No Withholding Tax:

The absence of withholding tax further adds to the appealing tax structure.

Government Funding and Support:

Support opportunities, including funding and assistance for company formation costs, contribute to a favorable startup ecosystem.

Mainland Jurisdiction

Understanding the concept of UAE mainland is crucial:

Definition:

UAE mainland refers to the geographic area permitted by the Department of Economic Development (DED) for business entities to operate freely.

Advantages:

Mainland businesses enjoy various benefits, such as no minimum capital requirement, a quick registration process, flexibility in setting up offices anywhere in the UAE, and the ability to engage with both private and public sectors.

Visa Issuance:

There is no cap on the number of visas issued, subject to office size, allowing businesses to scale their workforce without limitations.

Profit Repatriation:

Mainland companies can repatriate capital and profits up to 100%, offering financial flexibility.

Tax Exemptions:

Exemption from corporate and income tax, along with no annual audits, simplifies financial operations.

Types of Mainland Business Setup in UAE

Understanding the legal structures and licenses available is crucial:

Legal Types:

Mainland business setup includes options like Limited Liability Company, Civil Company, Sole Establishment, Subsidiary Company, and various types of Branch Offices.

License Categories:

Mainland businesses can obtain licenses in categories such as Professional, Commercial, Industrial, and Tourism, catering to diverse industry needs.

Timeline and Process

The UAE boasts an efficient business setup process:

Ease of Doing Business:

The UAE ranks 16 among 190 economies for ease of doing business, ensuring a streamlined process.

Quick Incorporation:

Companies can become operational within one week, requiring minimal documentation.

Choosing the right partner is crucial for a smooth business setup journey:

Expert Guidance:

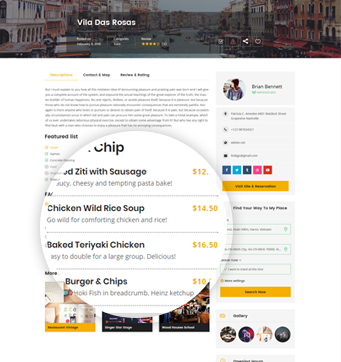

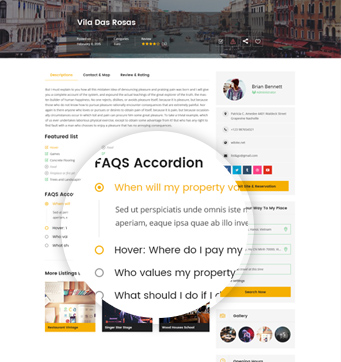

The UAE Directory Corporate listing Services specializes in Mainland Business Setup in Dubai/UAE, providing comprehensive assistance from registration to trade license acquisition.

Government Liaison:

With strong links with ministries and government bodies, The UAE Directory ensures speedy approvals for clients.

Customized Services:

The UAE Directory offers tailored services, including Mainland Business Setup, sponsorship, PRO services, liquidation services, trade licensing, and more.

Post-Setup Services:

Post-formation, The UAE Directoryextends support in strategy, taxation, legal advisory, mergers & acquisitions, and other essential areas.

Partner with The UAE Directory to navigate the intricacies of Mainland Business Setup in Dubai/UAE. Benefit from a comprehensive range of services and expert guidance throughout your entrepreneurial journey.