A Comprehensive Guide to Successfully Sell Your Business in the UAE

If you’re contemplating selling your business in the UAE, you’re not alone. Many entrepreneurs in the region decide to embark on this journey for various reasons, be it retirement, financial considerations, or the pursuit of new ventures. While selling a business in the UAE can be intricate, adhering to a systematic approach can significantly enhance your chances of a successful sale. This step-by-step guide covers key aspects and answers common questions at each stage of the process.

1. Prepare Your Business for Sale

To present your business in the best light possible, meticulous preparation is crucial. This involves:

Business Valuation: Determine the value of your business to set a realistic asking price.

Financial Analysis: Review financial statements for accuracy and currency.

Legal Compliance: Ensure compliance with all relevant laws and regulations.

Due Diligence: Allow potential buyers to scrutinize your business for verification.

Business Operations Review: Enhance efficiency by reviewing and refining operational processes.

Market Research: Understand your position by analyzing the target market, competition, and industry trends.

2. Determine the Value of Your Business

Crucial to the selling process is accurately determining the value of your business. Consider:

Business Appraisal: Employ various methods and techniques to assess your business’s value.

Valuation Methods: Explore approaches like market, income, and asset-based methods.

Comparable Sales Analysis: Compare your business to similar ones recently sold.

Discounted Cash Flow Analysis: Calculate the present value of future cash flows.

Asset-Based Valuation: Evaluate your business based on tangible and intangible assets.

Industry Benchmarks: Utilize industry-specific data and benchmarks for valuation.

3. Find a Suitable Buyer

Locating the right buyer is challenging but essential for securing the best price. Explore various channels:

Business Brokers: Professionals specializing in business sales.

Mergers and Acquisitions: Engage in processes for buying, selling, and combining businesses.

Marketing Your Business for Sale: Develop a marketing plan, including sales prospectuses.

Targeted Marketing: Identify and reach out to potential buyers.

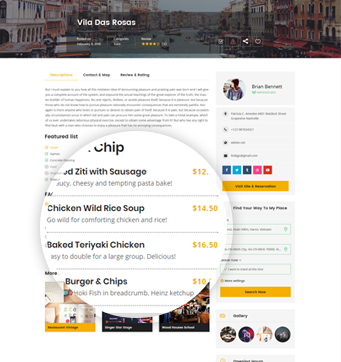

Online Marketplaces: Utilize platforms like BusinessFinder.ae, BizBuySell, or BusinessBroker.net.

Networking: Leverage personal and professional networks.

Industry Associations: Collaborate with organizations specific to your industry or niche.

4. Negotiate the Terms of the Sale

Negotiation is a critical step in ensuring favorable terms for your business sale. Consider:

Letter of Intent: A non-binding document outlining basic terms.

Purchase Agreement: A legally binding document detailing final terms and conditions.

Price Negotiation: Reach a mutually acceptable sale price.

Payment Terms Negotiation: Negotiate down payment, financing, and earn-out terms.

Non-Compete Agreement: An agreement preventing competition for a specified period.

Due Diligence: A comprehensive review by the buyer of your business’s risks and liabilities.

5. Close the Sale

The final step involves the actual transfer of ownership and payment receipt. Key considerations include:

Closing Process: Finalize asset transfers, legal documents, and payment.

Due Diligence Checklist: Outline all necessary documents for buyer review.

Asset Transfer: Transfer ownership of tangible and intangible assets.

Payment: Receive payment, ensuring all financial obligations are met.

Tax and Legal Compliance: Fulfill all tax and legal obligations.

Post-Sale Transition: Assist the buyer in the transition process.

6. Plan for the Future

After the sale, it’s crucial to plan for your future. Consider:

Financial Planning: Develop a plan for investing, saving, and retirement.

Tax Planning: Minimize taxes on the sale using tax-efficient structures or strategies.

Asset Protection: Take steps to protect assets from potential risks.

Starting a New Business: Utilize proceeds to start a new venture.

Investing: Use proceeds to invest in stocks, real estate, or other assets.

Retirement Planning: Develop a plan for retirement savings and investment.

In conclusion, selling a business in the UAE demands meticulous planning and execution. By following these steps and considering key strategies, you can enhance online visibility, attract potential buyers, secure a fair sale price, and ensure a financially stable future.